IVD Contract Manufacturing Market Size to Worth USD 56.90 Billion, Rising at 10.44% CAGR by 2034

The global IVD contract manufacturing market size is calculated at USD 23.34 billion in 2025 and is expected to reach around USD 56.9 billion by 2034, growing at a CAGR of 10.44% for the forecasted period.

Ottawa, Oct. 27, 2025 (GLOBE NEWSWIRE) -- The global IVD contract manufacturing market size was valued at USD 21.13 billion in 2024 and is predicted to hit around USD 56.9 billion by 2034, rising at a 10.44% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

The growing prevalence of chronic diseases and infectious diseases increases the demand for more advanced and efficient diagnostic tests, which drives the growth of the market.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5797

Key Takeaways

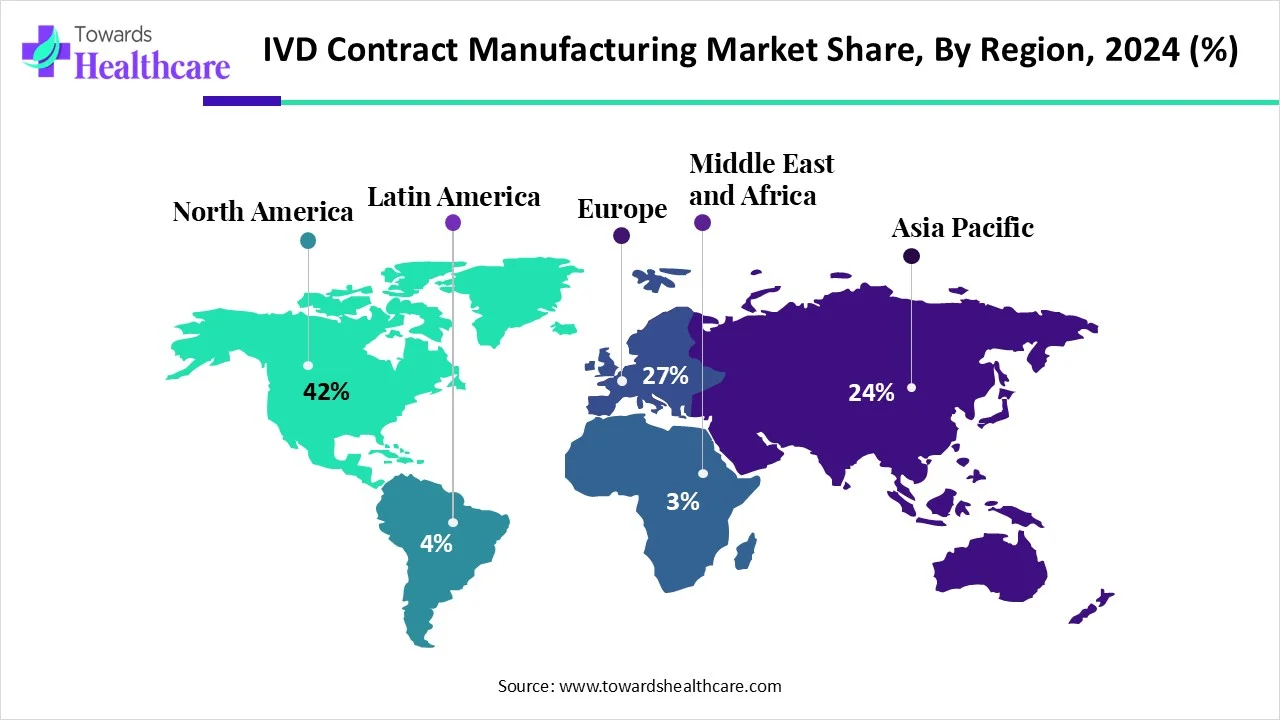

- North America dominated the IVD contract manufacturing market share by 42% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By product, the reagents & consumables segment held the largest revenue of the market in 2024.

- By product, the instruments segment is expected to grow at a significant CAGR during the forecast period.

- By service, the manufacturing services segment dominated the market in 2024.

- By service, the assay development segment is expected to grow significantly during 2025-2034.

- By technology, the immunoassays segment captured the largest revenue of the market in 2024.

- By technology, the clinical chemistry segment is expected to grow at a lucrative CAGR during the forecast period.

- By end-use, the medical device companies segment dominated the IVD contract manufacturing market in 2024.

- By end-use, the academic & research institutions segment is expected to grow at a significant CAGR during the forecast period.

Market Overview & Potential

IVD contract manufacturing is rising rapidly as a result of the increasing demand from diagnostic laboratories and healthcare organisations for one-stop-shop solutions. The motivation for this development is the aim for faster reaction times, more productivity, and lower costs in the diagnostic process. Additionally, leasing IVD equipment has emerged as a popular business model that enables smaller laboratories and research facilities to obtain state-of-the-art diagnostic technology without having to make the first financial commitment.

What is the Growth Potential Responsible for the IVD Contract Manufacturing Market?

The IVD contract manufacturing market is driven by factors like the increasing outsourcing of production by IVD original equipment manufacturers (OEMs), the growing demand for IVD tests due to rising chronic and infectious diseases, and the increasing complexity of diagnostic products. The market is fueled by strategic collaborations and partnerships between IVD OEMs and contract manufacturers to leverage their respective strengths. Other key drivers include cost savings from outsourcing, faster product development cycles, and strategic partnerships between OEMs and contract manufacturers.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What Are the Growing Trends Associated with the IVD Contract Manufacturing Market?

Outsourcing to emerging markets:

- A major trend is the outsourcing of manufacturing to emerging economies, particularly in the Asia-Pacific region, due to lower labour costs and a growing skilled workforce.

Demand for point-of-care testing (POCT):

- The market is being driven by the growing preference for POCT services and the associated need for specialised manufacturing capabilities.

Increased demand for specific segments:

- The market is seeing strong growth in the manufacturing of immunoassays, reagents, and consumables, which are key components of in-vitro diagnostic kits.

Focus on cost-efficiency and scalability:

- Companies are outsourcing to reduce costs, gain access to technology and expertise, and scale production more efficiently.

Government support:

- Post-pandemic government support for scaling up IVD kit production is also a significant driver.

What Is the Challenge in the IVD Contract Manufacturing Market?

The IVD contract manufacturing market faces challenges, including high development costs, complex regulatory compliance, and risks of intellectual property (IP) theft and cross-contamination. Other issues include the need for constant innovation to balance costs with advanced technology, and the difficulty for small and mid-sized manufacturers to make large investments in automation and robotics.

Regional Analysis

Download the single region market report @ https://www.towardshealthcare.com/checkout/5797

How Did North America Dominate the IVD Contract Manufacturing Market in 2024?

North America dominated the IVD contract manufacturing market share by 42% in 2024. North America dominates the IVD contract manufacturing market, driven by advanced diagnostic infrastructure, high healthcare expenditure, and established biomanufacturing ecosystems in the U.S. and Canada. Strategic collaborations between diagnostic developers and contract manufacturers enhance production efficiency, particularly for molecular and immunoassay diagnostics. Strong regulatory frameworks, robust clinical testing networks, and growing demand for point-of-care diagnostics further propel regional market expansion.

What Made the Asia Pacific Significantly Grow in The IVD Contract Manufacturing Market In 2024?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The Asia Pacific region is witnessing rapid growth due to cost-effective manufacturing, rising chronic disease burden, and increasing adoption of automated diagnostic technologies. Countries like China, India, and Singapore are becoming global hubs for IVD outsourcing, supported by favourable government policies, expanding laboratory networks, and a skilled technical workforce. Regional players are focusing on reagent production and instrument assembly to serve global demand efficiently.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Segmental Insights

By Product,

The reagents & consumables segment held the largest revenue of the market in 2024. Reagents and consumables represent the largest product segment in the IVD contract manufacturing market, as they are essential for daily diagnostic testing operations. Manufacturers provide customised reagent formulations, quality control materials, and test kits for diverse applications. The continuous demand from clinical chemistry, haematology, and molecular diagnostics ensures steady growth, with increasing outsourcing for bulk reagent production and sterilised consumable packaging.

The instruments segment is expected to grow at a significant CAGR during the forecast period. Instrument manufacturing involves contract-based production of analysers, automation systems, and diagnostic devices. OEMs collaborate with contract manufacturers to reduce costs, accelerate product launches, and ensure compliance with regulatory standards. Rising demand for compact, connected, and high-throughput analysers is driving partnerships, particularly for immunoassay and molecular testing platforms requiring precise engineering and component integration.

By Service,

The manufacturing services segment dominated the market in 2024. Manufacturing services dominate the IVD outsourcing landscape, covering end-to-end production from component sourcing to final assembly and quality validation. Contract manufacturers specialise in scaling production volumes while maintaining consistent product reliability and regulatory adherence. Growing pressure on diagnostic developers to streamline operations and reduce time-to-market is accelerating the outsourcing of reagent and device manufacturing functions.

The assay development segment is expected to grow significantly during 2025-2034. Assay development services focus on custom design, optimisation, and validation of diagnostic tests for specific biomarkers or disease targets. Contract partners offer analytical expertise, prototype formulation, and technology transfer to support assay commercialisation. Increasing demand for rapid and multiplex testing has encouraged companies to outsource assay design, ensuring technical precision and accelerated regulatory approval timelines.

Get the latest insights on life science industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

By Technology,

The immunoassays segment captured the largest revenue of the market in 2024. Immunoassays account for a major share of the IVD contract manufacturing market, widely used in infectious disease, oncology, and hormone testing. Manufacturers provide specialised coating, reagent stabilisation, and assembly services for ELISA and lateral flow devices. Growing adoption of high-sensitivity immunoassays and automation in clinical laboratories fuels demand for flexible, cost-efficient manufacturing partnerships.

The clinical chemistry segment is expected to grow at a lucrative CAGR during the forecast period. Clinical chemistry technologies involve biochemical analysis of blood and bodily fluids, requiring high-quality reagents and precision instrumentation. Contract manufacturers offer large-scale reagent formulation, lyophilisation, and instrument integration services. The segment benefits from increasing demand for routine diagnostic tests and the growing shift toward automated, high-throughput analysers in hospitals and diagnostic laboratories worldwide.

By End-Use,

The medical device companies segment dominated the IVD contract manufacturing market in 2024. Medical device companies form the largest customer base for IVD contract manufacturing, relying on external expertise to manage production scalability and regulatory compliance. These partnerships enable faster commercialisation of innovative diagnostic platforms while controlling costs. The growing demand for integrated diagnostic devices and point-of-care solutions strengthens collaboration between device OEMs and specialised manufacturers.

The academic & research institutions segment is expected to grow at a significant CAGR during the forecast period. Academic and research institutions increasingly partner with contract manufacturers for assay prototyping, pilot-scale reagent production, and device testing. Outsourcing allows research teams to focus on innovation while leveraging external technical expertise and GMP-compliant facilities. This trend supports translational research and early-stage development of diagnostic technologies targeted for commercialisation and clinical validation.

Browse More Insights of Towards Healthcare:

The global IVD diagnostic molecule raw enzymes market was valued at USD 2.39 billion in 2024, increasing to USD 2.56 billion in 2025, and is expected to reach approximately USD 4.73 billion by 2034, growing at a CAGR of 7.13% from 2025 to 2034.

The diagnostic testing market stood at USD 203.3 billion in 2024, is anticipated to rise to USD 209.48 billion in 2025, and is projected to achieve around USD 274.53 billion by 2034, expanding at a CAGR of 3.04% during the forecast period.

The allergy diagnostics market was valued at USD 5.79 billion in 2024, reached USD 6.42 billion in 2025, and is forecasted to touch nearly USD 16.45 billion by 2034, witnessing a strong CAGR of 10.96% between 2025 and 2034.

The point-of-care molecular diagnostics market was valued at USD 4.05 billion in 2024, increased to USD 4.48 billion in 2025, and is projected to reach USD 11.03 billion by 2034, expanding at a CAGR of 10.45% over the forecast period.

The infectious disease diagnostics market reached USD 25.01 billion in 2024 and is estimated to grow to USD 27.43 billion in 2025, with expectations to hit approximately USD 62.95 billion by 2034, registering a CAGR of 9.67% during 2025–2034.

The veterinary infectious disease diagnostics market was valued at USD 2.68 billion in 2024, expanded to USD 2.89 billion in 2025, and is anticipated to reach USD 5.76 billion by 2034, growing at a CAGR of 7.95% from 2025 to 2034.

The precision diagnostics & medicine market reached USD 146.88 billion in 2024, grew to USD 162.88 billion in 2025, and is expected to reach about USD 412.95 billion by 2034, advancing at a robust CAGR of 10.89% between 2025 and 2034.

Meanwhile, the rapid genomic diagnostics market and the LC-MS/MS-based diagnostics market are experiencing substantial global growth, with revenues expected to climb into the hundreds of millions of dollars by 2034.

The autoimmune disease diagnostics market was valued at USD 5.75 billion in 2024, rose to USD 6.11 billion in 2025, and is forecasted to reach around USD 10.5 billion by 2034, expanding at a CAGR of 6.22% during the forecast period.

Recent Developments

- In June 2025, Fujirebio enhanced its position as a supplier of vital and superior biological raw materials to the IVD and life research sectors by acquiring Plasma Services Group.

- In May 2025, with the introduction of the National Essential In-vitro Diagnostics List (NEIDL) and the transfer of quality-critical laboratory equipment and reagents, Nepal has made significant progress in developing its public health and health security infrastructure. These initiatives were funded by the WHO under the Pandemic Fund.

IVD Contract Manufacturing Market Key Players List

- Jabil Inc.

- Sanmina Corporation

- TE Connectivity

- Celestica Inc.

- Savyon Diagnostics

- West Pharmaceutical Services, Inc.

- Thermo Fisher Scientific

- KMC Systems

- Cenogenics Corporation

- Novo Biomedical

- Cone Bioproducts

- Invetech

- AVIOQ Inc.

- Meridian Bioscience Inc.

- Nemera

Download the Competitive Landscape market report @ https://www.towardshealthcare.com/checkout/5797

Segments Covered in The Report

By Product

- Instruments

- Reagents & Consumables

- Software & Services

By Service

- Manufacturing Services

- Assay Development Services

- Other Services

By Technology

- Immunoassays

- Clinical Chemistry

- Molecular Diagnostics

- Hematology

- Microbiology

- Coagulation

- Others

By End-use

- Medical Device Companies

- Academic & Research Institutions

- Others

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5797

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.