Liquid Dietary Supplements Market Size to Exceed USD 54.50 Billion by 2034 | Towards FnB

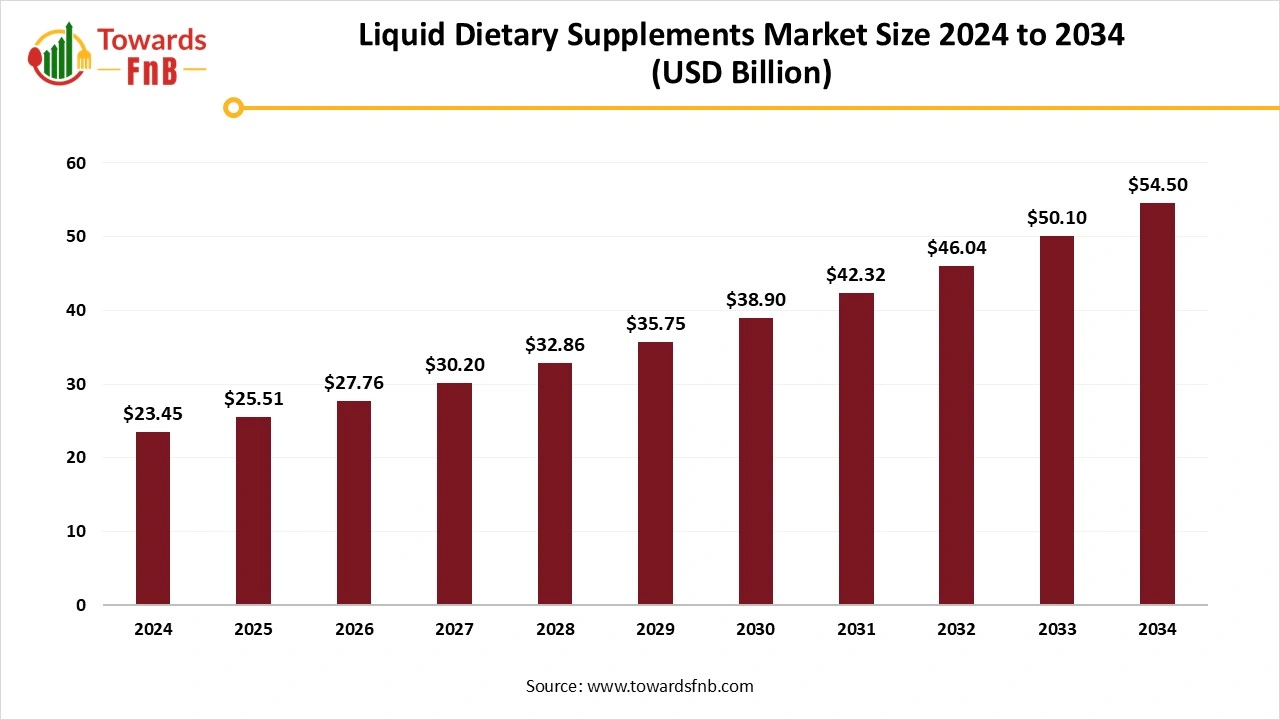

According to Towards FnB, the global liquid dietary supplements market size is evaluated at USD 25.51 billion in 2025 and is anticipated to surge USD 54.50 billion by 2034, reflecting at a CAGR of 8.8% from 2025 to 2034. The market has observed growth in the recent period due to rising health consciousness among consumers and rising demand for easy-to-consume healthy options, along with palatable preferences.

Ottawa, Oct. 27, 2025 (GLOBE NEWSWIRE) -- The global liquid dietary supplements market size stood at USD 23.45 billion in 2024 and is predicted to increase from USD 25.51 billion in 2025 to USD 54.50 billion by 2034, according to a report published by Towards FnB, a sister firm of Precedence Research.

Liquid dietary supplements are nutrient-rich formulations available in drinkable forms such as ready-to-drink (RTD) shots, syrups, and tinctures. These formats allow faster absorption and better palatability than tablets or capsules, catering to consumers seeking convenient nutrition.

“Consumers are moving away from pill fatigue toward fast-acting liquid formats that deliver measurable wellness benefits,” said Vidyesh Swar, Principal Consultant at Towards FnB. “Rising investment in personalized nutrition and AI-assisted formulation is reshaping how liquid supplements are developed and marketed globally.

Note: This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Access the Full Study Instantly | Download Sample Pages of the Report Now@ https://www.towardsfnb.com/download-sample/5875

Key Highlights of the Liquid Dietary Supplements Market

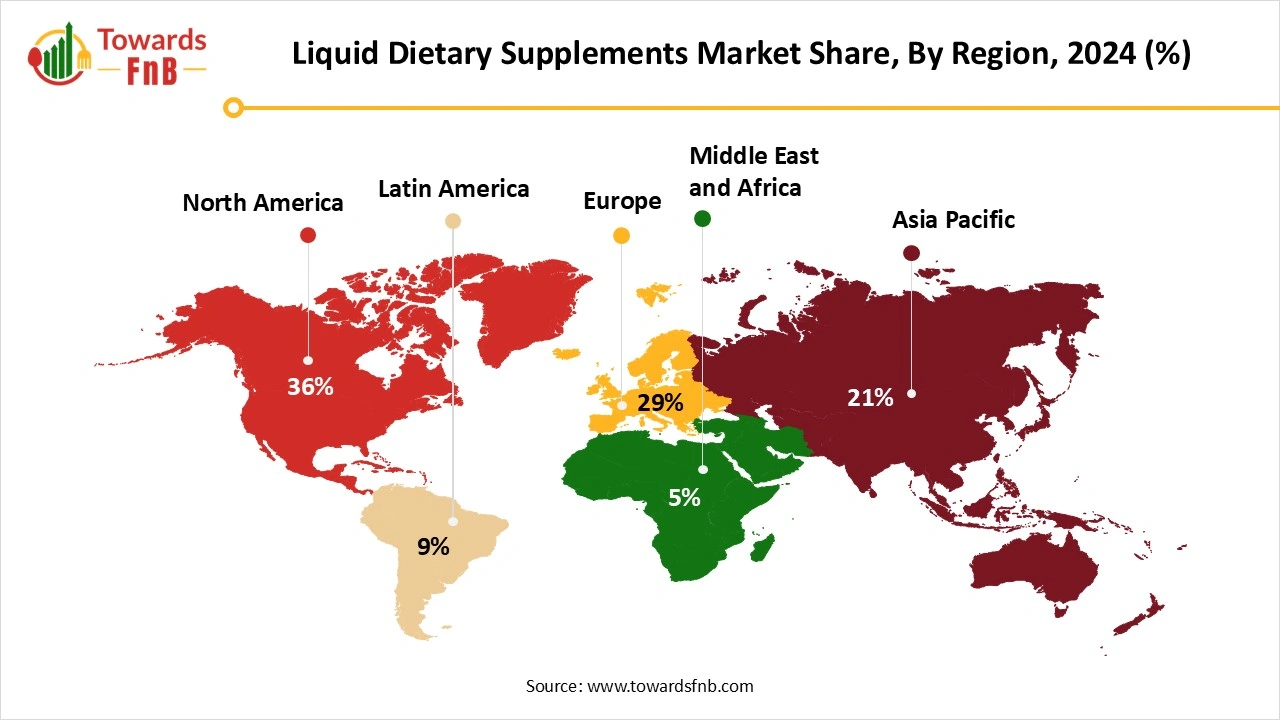

- By region, North America led the liquid dietary supplements market with the largest share of 36% in 2024, while the Asia Pacific region is expected to grow at a notable CAGR from 2025 to 2034.

- By delivery format, the RTD bottles and shots segment held the largest share of 41% in 2024, while the drops and tinctures segment is expected to grow at a CAGR of 22% from 2025 to 2034.

- By ingredient category, the vitamins and minerals segment contributed the biggest market share of 45% in 2024, whereas the probiotics and prebiotics segment is expanding at a CAGR of 22% between 2025 and 2034.

- By health benefit, the immune health benefits segment dominated with a 28% share in 2024, while the digestive and gut health segment is projected to grow significantly in the forecast period.

- By consumer group, the adult segment led the market with 62% in 2024, whereas the seniors' segment is expected to grow at a CAGR of 19% from 2025 to 2034.

- By distribution channel, the pharmacies and drugstores segment held the largest market share of 37% in 2024, while the online/e-commerce segment is expected to grow at a significant CAGR of 26% from 2025 to 2034.

- By packaging, the bottles (glass/PET) segment dominated with 63% of the market in 2024, while the single-serve ampoules/sachets segment is expected to grow at a CAGR of 21% over the projected period.

Rising Health Consciousness is helping the Growth of Liquid Dietary Supplements

The liquid dietary supplements market is expected to grow due to factors such as a growing health-conscious population, rising prevalence of different types of diseases, and an increasing population of aged people. Liquid dietary supplements allow health-conscious consumers to consume essential nutrients for the body in liquid form. It makes it easy for consumers and is also palatable to them. The liquid dietary supplements are available in different forms such as ready-to-drink bottles, concentrates, shots, syrups, and droppers, according to the convenience of consumers.

According to the International Food Information Council (IFIC), over 70% of global consumers in 2024 sought functional supplements or beverages for immunity and digestion. Liquid formats are increasingly preferred due to faster absorption and palatable taste, especially among adults and seniors adopting preventive health routines.

Impact of AI in the Liquid Dietary Supplements Market

Artificial intelligence (AI) is having a transformative impact on the liquid dietary supplements market, reshaping everything from product development and personalization to manufacturing, marketing, and regulatory compliance. Traditionally, liquid supplements were differentiated by faster nutrient absorption and convenience; now, AI is amplifying these advantages through data-driven innovation and precision formulation.

In research and development, AI algorithms are accelerating the discovery of new bioactive ingredients and optimizing formulations for stability, bioavailability, and taste. Machine learning models can simulate ingredient interactions and predict shelf-life performance, allowing manufacturers to fine-tune liquid supplement blends (e.g., vitamins, probiotics, herbal extracts) more efficiently. This shortens time-to-market and reduces R&D costs, which is particularly valuable in a sector where formulation stability is a challenge due to the nature of liquid matrices.

AI is also driving personalization, one of the fastest-growing trends in the supplement industry. By integrating data from genetic tests, microbiome profiles, wearable devices, and diet-tracking apps, AI systems can recommend individualized supplement blends or dosing schedules. For liquid products, such as daily nutrient shots or custom-mixed elixirs, AI enables brands to tailor ingredients and concentrations to consumers’ unique metabolic and lifestyle needs. This shift toward “precision supplementation” blurs the line between nutraceuticals and functional beverages, enhancing perceived value and consumer loyalty.

New Trends in the Liquid Dietary Supplements Market

- Increasing health awareness is one of the major factors in the growth of the market, leading to higher demand for liquid dietary supplements.

- Rising awareness of gut health leading to higher demand for probiotics, prebiotics, and synbiotics is another major factor for the growth of the market.

- The growing population of the senior and adult segment, concerned about their health profile, is acclaimed as one of the vital factors for the growth of the liquid dietary supplements market.

View Full Market Intelligence@ https://www.towardsfnb.com/insights/liquid-dietary-supplements-market

Recent Developments in the Liquid Dietary Supplements Market

- In February 2025, Kerry Group, a leader in taste and nutrition solutions, launched its 2025 supplement taste charts, a guide to evolving flavor trends and innovations in the wellness industry. The chart serves as a comprehensive guide for nutraceutical manufacturers to help them anticipate the market trend and make flavor shifts easily. (Source- https://en.antaranews.com)

- In August 2025, Audizen Drops, a liquid dietary supplement, launched Natural Tinnitus Support, inspired by Audifort, claiming to support clarity and offer targeted relief from tinnitus symptoms. (Source- https://www.globenewswire.com)

Trade Analysis for the Liquid Dietary Supplements Market

Regional Dynamics — Trade Implications

- North America (US): the largest regional market today (North America > ~33% share reported by IMARC) with high DTC channels, strong retail (mass + specialty), and considerable imports of active ingredients and finished products. The U.S. regulatory regime (DSHEA/FDA) focuses on labeling and permissible claims rather than pre-market approval for most supplements, but beverage-like or functional drink positioning can trigger additional food/regulatory requirements.

- Europe: sophisticated market with higher growth in premium functional formats; EU member states differ on claims/novel-food treatment, exporters must map both EU-level and country-level rules.

-

Asia-Pacific: often the fastest growth (mobile retail, functional hydration, elderly nutrition). However, regulatory heterogeneity (ingredient approvals, labeling languages, and import registration) and local manufacturing preferences create both opportunity and complexity for exporters.

Supply Chain & Customs — What Matters for Trade

- Product classification (HS/HTS) matters: liquid supplements may be classified under food preparation codes (e.g., HS 2106), vitamin/medicament codes (3004/2936), or beverage codes, depending on formulation and labeling, classification affects tariffs, permit requirements, and documentary checks. Use customs rulings and a tariff specialist for each SKU.

- Transport & packaging: liquids add weight, fragility, and packaging constraints (spillproof bottles, safety seals). Temperature sensitivity is generally lower than biologics, but it depends on certain concentrations/enzymes, which account for freight cost and possible cold chain if needed. (Industry logistics guides note classification and packaging issues for nutritional liquids).

-

Non-tariff barriers dominate: registration, labeling language, permitted ingredient lists, and documentary proof of Good Manufacturing Practice (GMP) or third-party testing commonly create the highest time/cost for market entry.

Regulatory & Claims Risk (Trade Critical)

- U.S. regime (DSHEA / FDA): most dietary supplements (including many liquids) can be marketed without pre-market approval, but labels must follow FDA rules and cannot make disease-treatment claims; there are additional FDA guidances on distinguishing liquid dietary supplements from beverages and on added substances (food additives). Noncompliance leads to import holds, detentions, or enforcement actions.

- EU & other markets: stricter novel-food and health-claim regimes exist; special ingredients (herbal extracts, new botanicals, high-dose actives) may require pre-market review. Account for country registration and authorized-ingredient lists.

-

Labeling & advertising enforcement: authorities (FDA, FTC in the US; national regulators in EU/APAC) enforce structure/function vs. disease claims. Claims enforcement (and classifying a product as a 'drug' vs 'supplement') is a principal reason imports are rejected.

Competitive Landscape & Commercial Trends

- Major players & channels: multinational consumer-health companies (Glanbia, Nestlé Health Science, Amway, Herbalife, Abbott, PepsiCo in functional beverages) and many specialized brands dominate different channels (RTD, shots, oral liquids, liposomal formats). Private label and contract manufacturing are important for exporters targeting retailers.

-

Product trends that affect trade:

- RTD functional drinks & shots (convenience; retail shelf space).

- Liposomal and enhanced-absorption liquid formats (premium pricing; ingredient sourcing).

- Clean-label, low-sugar, plant-based formulations affect ingredient sourcing and certification (organic, non-GMO).

For Detailed Pricing and Tailored Market Report Options, Click Here:

https://www.towardsfnb.com/checkout/5875

Liquid Dietary Supplements Market Regional Analysis

North America Led the Liquid Dietary Supplements Market in 2024

North America led the liquid dietary supplements industry in 2024 due to the rising prevalence of chronic health issues such as obesity, diabetes, and cardiovascular problems. Higher demand for ready-to-eat and convenient food options, a major health problem, also fuels the growth of the market. Growing technologies in the development of nutraceuticals and other health and wellness products also help to enhance the growth of the market. The US plays a major role in the growth of the market in the region.

Asia Pacific Is Expected to Grow in the Forecast Period

Asia Pacific is expected to grow in the expected timeframe due to the rising population of health-conscious consumers following a healthy lifestyle. The consumers in the region are aware of the importance of health and nutrition, and hence are observed to invest in health and wellness supplements and products helpful for the growth of the liquid dietary supplements market. High prevalence of lifestyle-related diseases and their damaging side effects also help to fuel the growth of the market in the foreseeable period.

Liquid Dietary Supplements Market Report Scope

| Report Attribute | Key Statistics |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Growth Rate from 2025 to 2034 | CAGR of 8.8% |

| Market Size in 2025 | USD 25.51 Billion |

| Market Size in 2026 | USD 27.76 Billion |

| Market Size by 2034 | USD 54.50 Billion |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Have Questions? Let’s Talk—Schedule a Meeting with Our Insights Team: https://www.towardsfnb.com/schedule-meeting

Liquid Dietary Supplements Market Segmental Analysis

Delivery Analysis

The RTD bottles and shots segment led the liquid dietary supplements market in 2024 due to their convenience, easy consumption, ease of carrying outdoors, and easy absorption by the body. Such bottles allow working professionals, students, athletes, and consumers with mobile lifestyles to have nutritional elements easily on the go without searching for a proper nutritious meal. RTD bottles are easy to carry and a convenient option for working professionals, students, and athletes to consume them anytime, and they are easily available in nearby stores and supermarkets, which is very helpful for the growth of the liquid dietary supplements market.

The drops and tinctures segment is expected to grow in the foreseen period as they have higher bioavailability, higher absorption rate, and easy consumption functionality. Tinctures are potent cannabis extracts that are usually kept under the tongue and have higher and faster absorption. They are consumed in a perfect dosage as per the physical requirements of the consumer and get the desired results in a quicker time. Drops allow consumers to customize their dosing accordingly to their requirements and maintain the quantity to avoid any harmful health side effects, further helpful for the growth of the liquid dietary supplements market.

Ingredient Category Analysis

The vitamins and minerals segment led the liquid dietary supplements market in 2024 due to the prevalence of lifestyle-related health issues such as diabetes, obesity, cholesterol, and heart issues. Consumption of vitamins and minerals regularly in various forms helps to lower the damage caused due to the scarcity of vitamins and minerals, further fueling the growth of the market. The essential nutrients also help to boost metabolism, which helps work professionals, athletes, and students, aiding the growth of the liquid dietary supplements market.

The probiotics/prebiotics segment is expected to grow in the foreseeable period due to rising awareness regarding improved gut health. A healthy gut is essential for a proper immune system and is also a major factor in the improved gut-brain link. The segment focuses on enhanced gut health to lower the side effects of other digestive issues, such as IBS, which is helpful for the growth of the liquid dietary supplements market in the foreseeable period. The rising demand for synbiotics, a product with the benefits of both prebiotics and probiotics, is further fueling the growth of the liquid dietary supplements market in the foreseeable period.

Health Benefit Analysis

The immune health segment led the liquid dietary supplements market in 2024 due to higher demand for immunity-enhancing supplements by health-conscious consumers and the aging sector of the population. Supplements such as zinc, calcium, elderberry, and probiotics, known for their immunity-strengthening properties, further fuel the growth of the market. Probiotics also help the growth of the market due to their digestion-improving properties and overall immunity-strengthening factors as well.

The digestive and gut health segment is expected to grow in the foreseeable period due to the rising importance of gut health and its link with body nutrition. Improved gut health is essential for the overall body. Hence, a healthy gut is essential for a healthy body, further fueling the growth of the market. Factors such as preventive health, improving microbiome treatments, and increased global regulation also help the growth of the market in the foreseeable period. Higher demand for processed food due to its convenience, rising digestive health issues such as IBS, also aids in the growth of the liquid dietary supplements industry.

Consumer Group Analysis

The adult segment led the liquid dietary supplements sector in 2024 due to its growing population, higher inclination towards commonly observed health issues such as diabetes, obesity, and heart problems, and rising awareness regarding health and wellness. The segment also aids the growth of the market due to the segment’s inclination towards investment in health and fitness gadgets, supplements, and other essentials required for a healthy system. The adult segment also shows an inclination towards health and wellness lifestyle habits for improved immunity and a lower risk of various diseases.

The seniors segment is expected to grow in the foreseen period due to the rising awareness of the segment towards a healthy lifestyle and the growing importance of nutrients for the body. The senior segment faces common issues such as muscle loss, reduced food consumption capacity, and lower nutrient absorption. Hence, the segment plays a vital role in the high demand for liquid dietary supplements. Liquid supplements have a high absorption rate and are easy for seniors to consume, which further fuels the growth of the market.

Distribution Channel Analysis

The pharmacies and drug stores segment led the liquid dietary supplements industry in 2024 due to easy visibility of such stores near residential areas, allowing consumers to buy the required essentials. Such stores have also been trusted by consumers for a long time as they provide the required pharmaceutical product along with detailed information, further instilling consumers’ trust, which is helpful for the higher demand of liquid dietary supplements.

The e-commerce and online platforms segment is expected to grow in the foreseen period due to its convenience factor, helpful for the senior segment, allowing them to order the required supplement and get it delivered at the ease of home. Such factors add to the growth of the liquid dietary supplements market in the foreseeable period. The segment also helps the growth of the market due to the availability of a variety of required essentials and products at the ease of a fingertip and get them in a span of a few minutes.

Packaging Analysis

The bottles (glass/PET) segment led the industry of liquid dietary supplements in 2024 due to its convenience factor, ease of usage, and ease of carrying it outdoors as well. Various other factors, such as its attractive aesthetics, which are helpful for brands to attract consumers, its lightweight, clarity, and good quality, also help to fuel the growth of the market. The superior quality glass also helps the brands to keep their product safe and enhance their shelf-life, further fueling the growth of the market. PET is affordable and recyclable, helpful to maintain sustainability, and aids the growth of the market as well.

The single-serve ampoule/sachet segment is expected to grow in the expected timeframe due to factors such as effectiveness, cleanliness, affordability, and ease of usage. The segment has a huge consumer base of hectic, mobile life, and working professional consumers, who always have a crunch of time. Hence, the segment has a major role in the growth of the market.

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Additional Topics Worth Exploring:

- Tea Market: The global tea market size is projected to expand from USD 30.25 billion in 2025 to USD 54.68 billion by 2034, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034

- Beverage Packaging Market: The global beverage packaging market size is projected to reach USD 271.80 billion by 2034, growing from USD 173.71 billion in 2025, at a CAGR of 5.1% during the forecast period from 2025 to 2034.

- Gluten Free Food Market: The global gluten free food market size increasing from USD 14.25 billion in 2025 and is expected to surpass USD 33.59 billion by 2034, with a projected CAGR of 10% during the forecast period from 2025 to 2034.

- Canned Wines Market: The global canned wines market size is expected to increase from USD 127.88 million in 2025 to USD 332.46 million by 2034, growing at a CAGR of 11.2% throughout the forecast period from 2025 to 2034.

- Plant-Based Protein Market: The global plant-based protein market size is projected to expand from USD 20.33 billion in 2025 and is expected to reach USD 43.07 billion by 2034, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

- Bakery Product Market: The global bakery product market size is rising from USD 507.46 billion in 2025 to USD 821.62 billion by 2034. This projected expansion reflects a CAGR of 5.5% during the forecast period from 2025 to 2034.

- Coconut Products Market: The global coconut products market size is expected to climb from USD 14.18 billion in 2025 to approximately USD 33.71 billion by 2034, growing at a CAGR of 10.1% during the forecast from 2025 to 2034.

- Pet Food Market: The global pet food market size is expected to increase from USD 113.02 billion in 2025 to USD 167.97 billion by 2034, growing at a CAGR of 4.5% throughout the estimated timeframe from 2025 to 2034.

-

Fresh Produce Market: The global fresh produce market size is projected to grow from USD 3,707 billion in 2025 to approximately USD 5,653 billion by 2034. This anticipated growth represents a CAGR of 4.80% during the forecast period from 2025 to 2034.

Top Companies in the Liquid Dietary Supplements Market

- Herbalife Nutrition Ltd.: Herbalife Nutrition is a global leader in dietary supplements, offering a wide range of liquid nutrition products for energy, fitness, and wellness. Its liquid multivitamins and herbal concentrates are formulated for quick absorption and consumer convenience. Herbalife’s focus on scientifically backed formulations and global distribution supports its strong market position in liquid nutrition.

- Amway Corp. (Nutrilite): Amway’s Nutrilite brand provides premium liquid dietary supplements derived from plant-based ingredients. The company’s advanced extraction technologies and personalized nutrition programs enable consumers to meet specific health goals. Its strong global presence and focus on purity and traceability make Nutrilite one of the most trusted names in nutritional supplements.

- Abbott Laboratories: Abbott offers a comprehensive range of liquid dietary supplements, including its well-known Ensure and PediaSure product lines. These are designed to support nutrition in children, adults, and the elderly. Abbott’s emphasis on clinical validation and balanced formulations strengthens its leadership in medical and general nutrition products.

- The Bountiful Company (Nestlé Health Science): Now part of Nestlé Health Science, The Bountiful Company offers popular liquid supplement brands like Nature’s Bounty and Solgar. The company’s portfolio includes collagen, vitamins, and herbal liquids that target energy, immunity, and skin health. Its integration with Nestlé enhances innovation in personalized and functional nutrition.

- Bayer AG: Bayer’s Consumer Health division provides liquid dietary supplements designed for immune support, vitality, and general wellness. Its scientifically validated formulations, combined with the strength of trusted brands like Berocca, position Bayer as a top player in preventive health solutions.

- Pfizer Inc.: Pfizer’s Centrum and other liquid supplement lines are formulated to provide essential nutrients for adults and children. The company’s continued investment in R&D supports product efficacy and bioavailability, ensuring reliable nutrition delivery in liquid form.

- Glanbia plc: Glanbia offers functional liquid supplements under its Performance Nutrition division, focusing on protein-rich and recovery-oriented formulations. The company’s innovation in liquid whey and plant-based nutrition products caters to fitness-conscious consumers.

-

ADM (Archer Daniels Midland Company):

ADM produces plant-based ingredients and nutritional blends used in liquid dietary supplements globally. Its customized formulations enhance taste, stability, and nutrient absorption, supporting innovation in ready-to-drink nutrition. - BASF SE: BASF develops high-quality micronutrient and omega-3 ingredients used in liquid supplement formulations. Its expertise in emulsification and stability technologies ensures superior bioavailability and product shelf life.

- Nature’s Way Products, LLC: Nature’s Way manufactures herbal and vitamin-based liquid dietary supplements focused on immune, digestive, and energy support. The company’s clean-label and plant-derived formulations appeal to health-conscious consumers seeking natural alternatives.

- NOW Health Group, Inc.: NOW Health Group offers an extensive range of affordable liquid supplements, including amino acids, vitamins, and herbal extracts. Its commitment to quality testing and transparency supports its reputation among natural product consumers.

- Garden of Life (Nestlé Health Science): Garden of Life provides organic, whole-food-based liquid supplements designed for digestive and immune health. Its formulations emphasize traceable ingredients, vegan options, and certified organic sourcing.

- NutraBlast Inc.: NutraBlast develops women’s health-focused liquid dietary supplements that promote hormonal balance, digestion, and immunity. Its evidence-based approach and product transparency cater to the growing personalized wellness segment.

- Himalaya Wellness Company: Himalaya offers herbal liquid tonics and supplements that combine Ayurveda with modern nutritional science. Its products target immunity, energy, and liver health, appealing to consumers seeking natural wellness alternatives.

-

Liquid Health, Inc.: Liquid Health specializes exclusively in liquid vitamins and nutritional blends designed for optimal absorption. Its formulations include multivitamins, joint support, and prenatal supplements, manufactured using bioavailable nutrient complexes.

Segments Covered in the Report

By Delivery Format

- RTD Bottles & Shots

- Syrups & Tonics

- Drops & Tinctures

- Liquid Concentrates / Ampoules

By Ingredient Category

- Vitamins & Minerals

- Botanicals / Herbals

- Probiotics & Prebiotics

- Omega-3 & Specialty Lipids

- Amino Acids / Collagen / Protein

By Function/Health Benefit

- Immune Health

- Digestive & Gut Health

- Energy & Metabolism

- Bone & Joint

- Cognitive, Mood & Sleep

- Beauty & Skin

By Consumer Group

- Adults

- Children

- Seniors

- Prenatal/Perinatal

By Distribution Channel

- Pharmacies/Drugstores

- Supermarkets/Hypermarkets

- Online (eCommerce/D2C)

- Specialty Nutrition Stores

By Packaging

- Bottles (Glass / PET)

- Single-Serve Ampoules / Sachets

- Droppers / Spray Bottles

By Region

North America

- U.S.

- Canada

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

Latin America

- Brazil

- Mexico

- Argentina

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Thank you for exploring our insights. For more targeted information, customized chapter-wise sections and region-specific editions such as North America, Europe, or Asia Pacific—are also available upon request.

For Detailed Pricing and Tailored Market Report Options, Click Here: https://www.towardsfnb.com/checkout/5875

Feel Free to Get in Touch with Us for Orders or Any Questions at: sales@towardsfnb.com

Unlock expert insights, custom research, and premium support with the Towards FnB Annual Membership. For USD 495/month (billed annually), get full access to exclusive F&B market data and personalized guidance. It’s your strategic edge in the food and beverage industry: https://www.towardsfnb.com/get-an-annual-membership

About Us

Towards FnB is a global consulting firm specializing in the food and beverage industry, providing innovative solutions and expert guidance to elevate businesses. With an in-depth understanding of the dynamic F&B sector, we deliver customized market analysis and strategic insights. Our team of seasoned professionals is committed to empowering clients with the knowledge needed to make informed decisions, ensuring they stay ahead of market trends. Partner with us as we redefine success in the rapidly evolving food and beverage landscape, and together, we’ll navigate this transformative journey.

Web: https://www.towardsfnb.com/

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Chemical and Materials| Nova One Advisor | Food Beverage Strategies | FnB Market Pulse | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

For Latest Update Follow Us:

Discover More Market Trends and Insights from Towards FnB:

➡️Beverage Flavors Market: https://www.towardsfnb.com/insights/beverage-flavors-market

➡️Salt Market: https://www.towardsfnb.com/insights/salt-market

➡️Probiotic Food Market: https://www.towardsfnb.com/insights/probiotic-food-market

➡️Protein Bar Market: https://www.towardsfnb.com/insights/protein-bar-market

➡️Gluten-Free Bakery Market: https://www.towardsfnb.com/insights/gluten-free-bakery-market

➡️Europe Nutraceuticals Market: https://www.towardsfnb.com/insights/europe-nutraceuticals-market

➡️Canned Food Market: https://www.towardsfnb.com/insights/canned-food-market

➡️Non-Alcoholic Beverages Market: https://www.towardsfnb.com/insights/non-alcoholic-beverages-market

➡️Dry Fruit Market: https://www.towardsfnb.com/insights/dry-fruit-market

➡️Frozen Meat Market: https://www.towardsfnb.com/insights/frozen-meat-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.